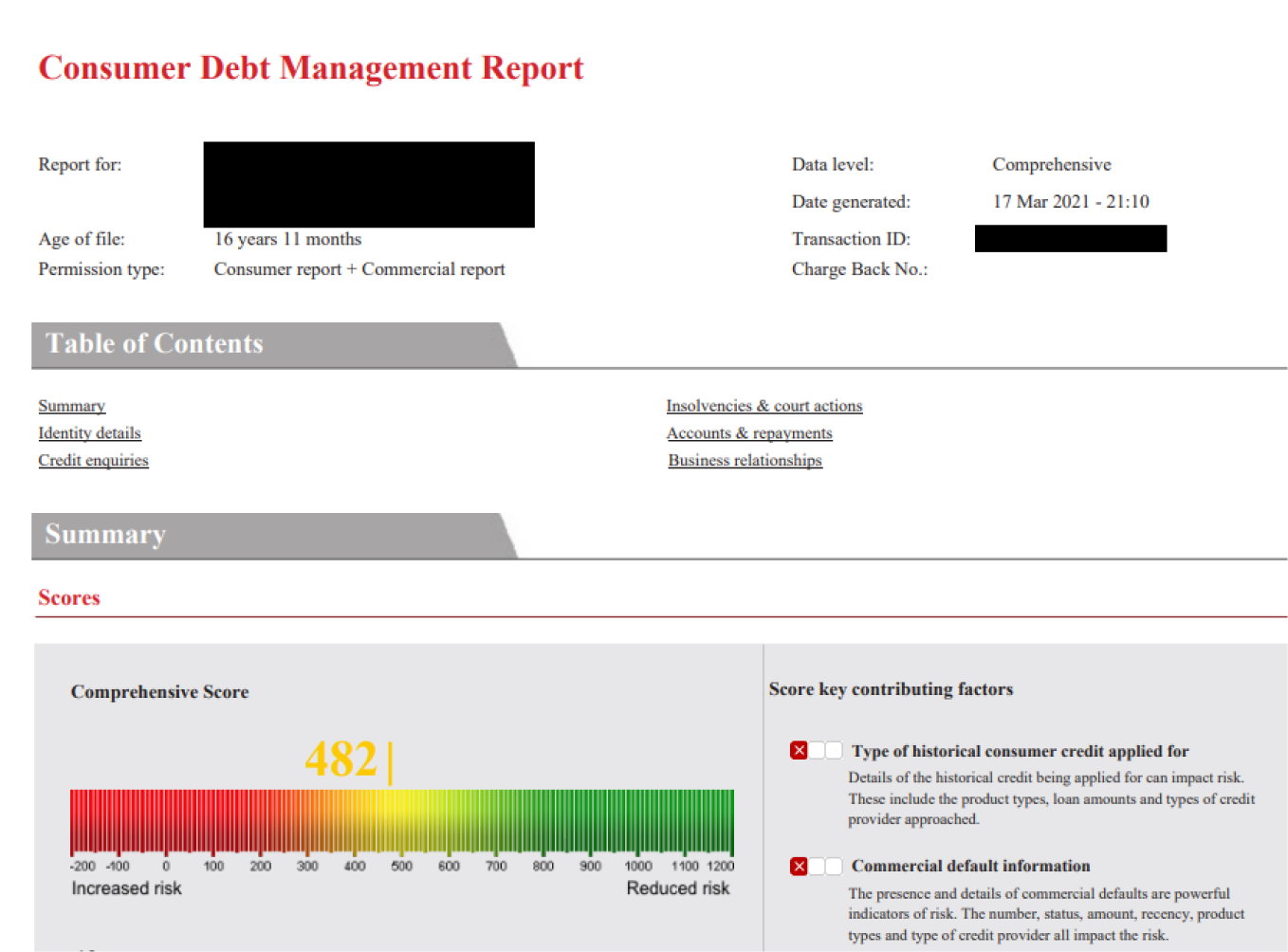

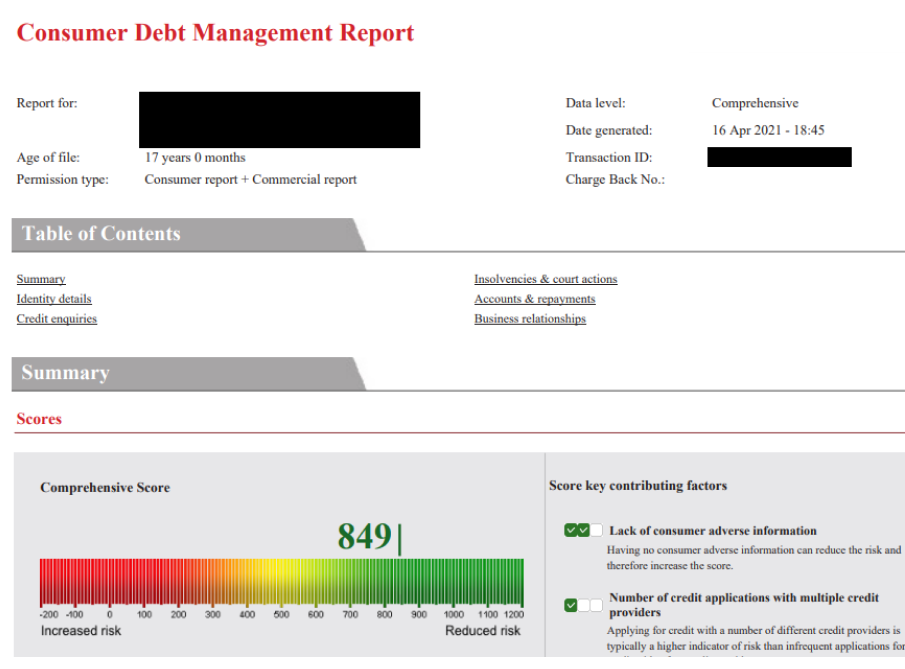

CASE STUDY

DISCOVER THE BON VOYAGE DIFFERENCE!

See for yourself exactly how much of a difference our services make in helping people like you achieve the peace of mind you need and financial freedom you want to live a better and more stress-free life.

MOVE THE SLIDER TO DISCOVER THE BON VOYAGE DIFFERENCE